FIZZ Lawsuit Underway: Fizz Class Action Report

Levi & Korsinsky, LLP

July 27, 2018

Luczak v. National Beverage Corp. et al 0:18-cv-61631-KMM — On July 17, 2018, investors sued National Beverage Corp. (National Beverage, FIZZ, or the Company) in United States District Court, Southern District of Florida. Plaintiffs in the FIZZ class action allege that they acquired National Beverage stock at artificially inflated prices between July 17, 2014 and July 3, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the FIZZ lawsuit, please continue reading, and reach out to us today!

Summary of the Allegations

Company Background

According to its website, National Beverage (NASDAQ: FIZZ) is an “acknowledged leader” in the creation, development and sales of soft drinks and related products.

As such, the Company has 12 manufacturing facilities in the United States and offers “the widest selection of flavored soft drinks, juices, sparkling waters, energy drinks and nutritionally–enhanced waters.” Consumers can find its products in supermarkets, national chains, convenience stores, restaurants, hospitals, schools, wholesale clubs, and other retail establishments.

Established as a holding company for its subsidiaries, National Beverage Corp. was incorporated in Delaware in 1985 and has been trading as a public company on the NASDAQ since 1991.

Summary of Facts

National Beverage and two of its senior executives (the “Individual Defendants”) are accused of deceiving investors by lying and withholding critical information about the Company’s business, operational and compliance policies during the Class Period.

Specifically, they are accused of omitting truthful information about the Company’s certain “proprietary techniques,” and its CEO’s conduct from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused National Beverage stock to trade at artificially inflated prices during the time in question.

The truth emerged in a series of events that transpired between December 8, 2017, when concerned analysts assigned “underperforming,” and “sell” classifications to National Beverage stock, and July 3, 2018. Of note in this context is an exchange of letters between the SEC and the Company regarding the Company’s prior statements about its “VPO and VPC metrics,” and an ensuing article published by the Wall Street Journal on June 26, 2018. The article revealed that the Company “declined to provide the requested figures.”

Then on July 3, the Wall Street Journal published another article revealing alleged sexual misconduct by the Company’s CEO (an Individual Defendant) between 2014 and 2016.

A closer look…

As alleged in the July 17 complaint, the Company repeatedly made false and misleading public statements during the Class Period.

For example, on a form filed with the SEC when the Class Period began, the Company referred to its Code of Ethics, which states in relevant part: “Any type of harassment, whether of a racial, sexual, ethnic or other nature, is absolutely prohibited.”

National Beverage also referred to its Code of Ethics in SEC filings on three other occasions during the Class Period.

Then, in a press release issued on May 4, 2017, the Company stated that it “employs methods that no other company does in this area – VPO (velocity per outlet) and VPC (velocity per capita).” It also claimed that it “utilize[s] two proprietary technique to magnify these measures and this creates growth never before thought possible.”

In another press release issued the next day, National Beverage stated that “[o]ur impressive VPO calculator… is flashing solid green numbers as we bring FY2017 to a close.”

Impact of the Alleged Fraud on National Beverage’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$109.94 |

| Closing stock price the trading day after disclosures:

|

$107.04 |

| Two day stock price decrease (percentage) as a result of disclosures:

|

2.64% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is September 17, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in National Beverage common stock using court approved loss calculation methods.

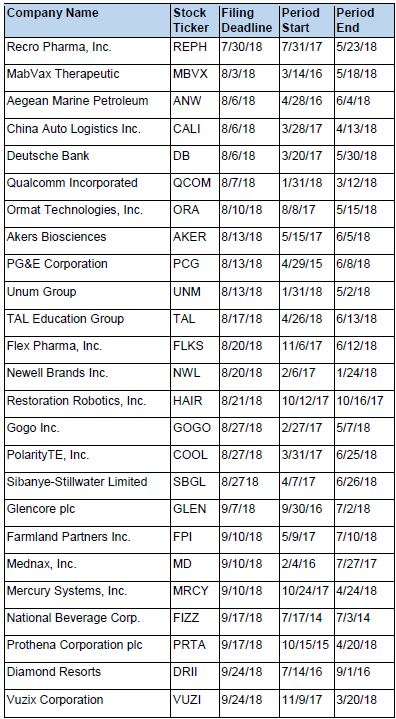

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

| This information is provided for general information purposes only, and should not be construed as legal advice, nor does it establish an attorney-client relationship with Levi & Korsinsky LLP. Any and all information herein is simply an opinion based on publicly available information and should not necessarily be construed as fact. For more information, please visit our website at www.zlk.com.

Attorney Advertising

|

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.