CHGG Lawsuit; Levi & Korsinsky Announces Chegg Class Action

Levi & Korsinsky, LLP

October 10, 2018

Shah v. Chegg Inc., et al 3:18-cv-05956-CRB — On September 27, 2018, investors sued Chegg, Inc., (“Chegg” or the “Company”) in United States District Court, Northern District of California. Plaintiffs in the Chegg class action allege that they acquired Chegg stock at artificially inflated prices between July 30, 2018 and September 25, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For information on the CHGG lawsuit, or to submit your losses, please contact us today!

Summary of the Allegations

Company Background

The Company (NYSE:CHGG) is a self-described “leading student-first interconnected learning platform.” As such, it provides the “tools and services that support students throughout their educational journey.”

Specifically, Chegg allows college and high school students to rent and sell textbooks, return their books, find affordable textbooks and find college textbooks. It also allows students to research different colleges and areas of study, along with various scholarships and internships. Finally, students using Chegg’s services can access online tutoring, study tools and standardized test preparation programs.

Summary of Facts

Chegg and its CEO (the “Individual Defendant”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices and prospects during the Class Period.

In particular, they are accused of omitting truthful information about the Company’s ability to protect user data and detect unauthorized access to its system from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Chegg stock to trade at artificially inflated prices during the time in question.

The truth came on out when the Company filed a form with the SEC on September 25, 2018. On it, Chegg said it recently learned that “an unauthorized party gained access to a Company database” on or around April 29, 2018. The Company also said that the database that had been breached “hosts the user data for chegg.com and certain of the Company’s family of brands such as EasyBib.”

The compromised information potentially belonging to as many as 40 million active and inactive registered users included their names, email addresses, shipping addresses, Chegg user names, and “hashed” Chegg passwords. At the time of the filing, however, the Company said it understood that, “no social security numbers or financial information such as users’ credit card numbers or bank account information were obtained.” Chegg also said an investigation “supported by third-party forensics” was ongoing at the time of the filing.

A closer look…

As alleged in the September 27 complaint, the Company and/or Individual Defendant repeatedly made false and misleading public statements during the Class Period.

For instance, in a press release issued on July 30, 2018, the Company said in relevant part: “We expanded our services, introduced the Chegg Math Solver subscription and, through the acquisition of StudyBlue, added flashcards, one of the most popular learning tools used by students around the world. We enter the fall semester with significant momentum, giving us confidence to once again raise our guidance for the year.”

On a form filed with the SEC that day, the Company also discussed its “vulnerability to unauthorized access to its systems and its data.” In this context it said in relevant part: “Efforts to prevent hackers from entering our computer systems are expensive to implement and may limit the functionality of our services. Though it is difficult to determine what, if any, harm may directly result from any specific interruption or attack, any failure to maintain performance, reliability, security and availability of our products and services and technical infrastructure may harm our reputation, brand and our ability to attract students to our website.”

Impact of the Alleged Fraud on Chegg’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$32.33 |

| Closing stock price the trading day after disclosures:

|

$28.42 |

| One day stock price decrease (percentage) as a result of disclosures:

|

12.09% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is November 26, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Chegg common stock using court approved loss calculation methods.

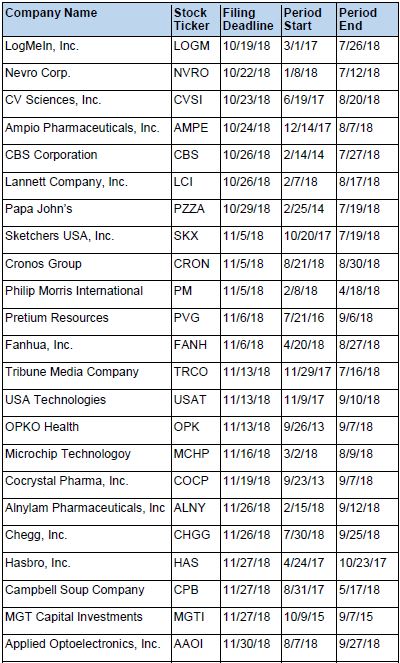

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.