Levi & Korsinsky Announced SYF Class Action; SYF Lawsuit

Levi & Korsinsky, LLP

November 26, 2018

Retail Wholesale Department Store Local 338 Retirement Fund v. Synchrony Financial, et al 3:18-cv-01818 — On November 2, 2018, investors sued Synchrony Financial (“Synchrony” or the “Company”) in United States District Court, District of Connecticut. Plaintiffs in the SYF class action allege that they acquired Synchrony stock at artificially inflated prices between October 21, 2016 and November 1, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon the Company’s alleged misconduct during that time. For more information on the SYF Lawsuit, please contact us today!

Summary of the Allegations

Company Background

The Company (NYSE: SYF) bills itself as “one of the nation’s premier consumer financial services companies.”

As such, it says it provides “a range of credit products through programs” it has created with “a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers” to help spur growth for its partners and afford financial flexibility to its customers.

Among other things, the Company issues “store branded credit cards,” from established retailers including but not limited to Lowe’s, Amazon and The Gap. According to the November 2 complaint, Synchrony is the largest provider of these “private-label” credit cards in the United States.

The Company, which says its roots in consumer finance can be traced back to 1932, is incorporated in Delaware and has corporate headquarters in Stamford, Connecticut. As of August 22, 2018, it had more than 740 million shares of stock outstanding.

Summary of Facts

Synchrony and two of its officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about its underwriting practices and the effects on its business from SEC filings and related material. By recklessly or knowingly doing so, they allegedly caused Synchrony stock to trade at artificially inflated prices during the time in question.

The truth initially surfaced on April 28, 2017, when the Company announced, “disappointing first quarter 2017 earnings driven by poor loan performance.” At the time, the Company revealed that it “would be setting aside over $1.3 billion in reserves to cover probable loan losses,” representing a dramatic increase in reserves compared to the prior quarter.

In the aftermath of these disclosures, which sent its stock price tumbling, the Company claimed that it “tightened” credit standards. However, the Company never told investors that this tactic damaged its partnerships with retailers, the most significant of which was Walmart.

In fact, the public didn’t become aware of the rift between Synchrony and Walmart until July 12, 2018, when news broke about the potential termination of the partnership. Then, on July 26, 2018, the media confirmed that Walmart had ended its relationship with Synchrony and chosen a competitor as its replacement.

Finally, on November 1, 2018, Walmart sued Synchrony “alleging that the Company deliberately underwrote the Walmart/Synchrony credit card program in a way that exposes the program to significant unique credit risk.” Walmart is purportedly seeking damages “in an amount… estimated to be no less than $800 million.”

A closer look…

As alleged in the November 2 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a presentation at an industry conference on November 3, 2016, the Company presented information indicating that it: “Focused on a Higher Quality Asset Base,” and maintained “Disciplined Underwriting” since “at least the third quarter of 2010 through the third quarter of 2016.”

Then, in an annual report filed with the SEC on February 23, 2017, Synchrony, “affirmed that it complied with critical accounting estimates in preparing its consolidated and combined financial statements, including in establishing allowance for loan losses, which requires the Company to make its best estimate of probable losses inherent in the portfolio.”

Finally, on an April 20, 2018 conference call held to discuss Synchrony’s earnings for the first quarter 2018, one of the Individual Defendants said in pertinent part: “We started to make refinements to our underwriting in the second half of 2016, and we continue to see the positive impact of those changes.”

During the same conference call, the second Individual Defendant also said the Company was “well entrenched” with its partners.

Impact of the Alleged Fraud on Synchrony’s Stock Price and Market Capitalization :

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is January 2, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Synchrony common stock using court approved loss calculation methods.

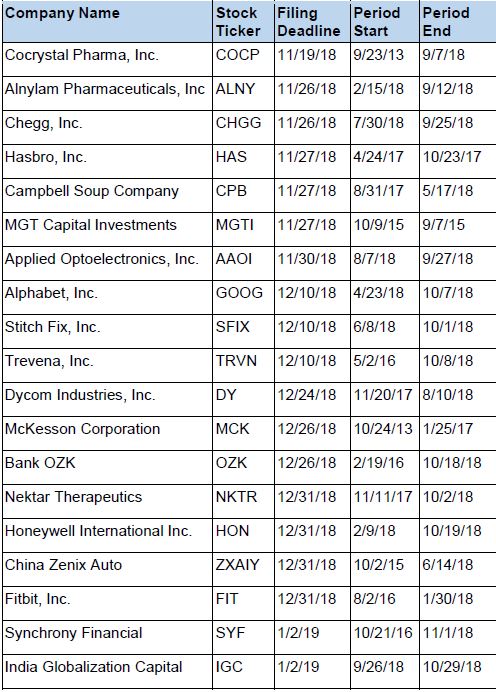

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net-worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.