Levi & Korsinsky Announce CORT Lawsuit; CORT Class Action

Levi & Korsinsky, LLP

April 4, 2019

Melucci v. Corcept Therapeutics Inc., et al 5:19-cv-01372-LHK — On March 14, 2019, investors sued Corcept Therapeutics, Inc. (“Corcept” or the “Company”) in United States District Court, Northern District of California. Plaintiffs in the federal securities class action allege that they acquired Corcept stock at artificially inflated prices between August 2, 2017 and February 5, 2019 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during the time in question. For more information on the CORT lawsuit, please contact us today!

Summary of the Allegations

Company Background

Corcept (NASDAQ: CORT) is a drug company that claims to “committed to improving patient lives through the discovery and development of drugs that address serious unmet medical needs related to excess cortisol activity.” These conditions include dangerous forms of cancer, mental illnesses and metabolic disorders.

To achieve its goal, the Company says it teams up with “numerous basic scientists and clinical researchers to find better ways to improve patient lives.” The Company also says these global partnerships have resulted in 30 investigative studies regarding possible uses for glucocorticoid receptor antagonists may have in the treatment of “serious and life-threatening diseases driven by cortisol dysregulation.”

According to the March 14 complaint, the FDA has approved a Corcept drug called Korlym for the treatment of “hyperglycemia secondary to hypercortisolism in adult patients with endogenous Cushing’s Syndrome.”

Summary of Facts

Corcept and two of its senior officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and/or withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about certain conduct related to the promotion of Korlym, and the Company’s relationship with its only specialty pharmacy from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Corcept’s stock to trade at artificially inflated prices during the time in question.

The truth came out in a series of events that occurred between January 25, 2019 and February 5, 2019. First, SIRF published a report “alleging that Corcept paid doctors to prescribe its drug Korlym for off-label uses.” Then, on January 31, 2019, the Company “forecast a sharp slowdown in the sales of Korlym…”

Finally, on February 5, 2019, Blue Orca Capital “published a report alleging that Corcept’s ‘sole specialty pharmacy and exclusive distributor is an undisclosed related party’ called Optime Care (‘Optime’).” Blue Orca Capital claimed that this “creates a material risk that the Company is using its captured pharmacy to boost sales, hide losses or engage in other financial shenanigans.”

A closer look…

As alleged in the March 14 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, on a form filed with the SEC on February 28, 2018, the Company stated in pertinent part: “Although physicians are permitted to prescribe drugs for indications other than those approved by the FDA, manufacturers are prohibited from promoting products for such off-label uses.”

On the same form, Corcept also said in pertinent part: “Although we believe our marketing materials and training programs for physicians do not constitute ‘off-label’ promotion of Korlym, the FDA may disagree.”

Finally, on the same form, the Company “stated that one specialty pharmacy, Optime Care, Inc., represents approximately 99 percent of the Company’s revenue.”

Impact of the Alleged Fraud on Corcept’s Stock Price and Market Capitalization

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Corcept common stock using court approved loss calculation methods.

Recently Filed Cases

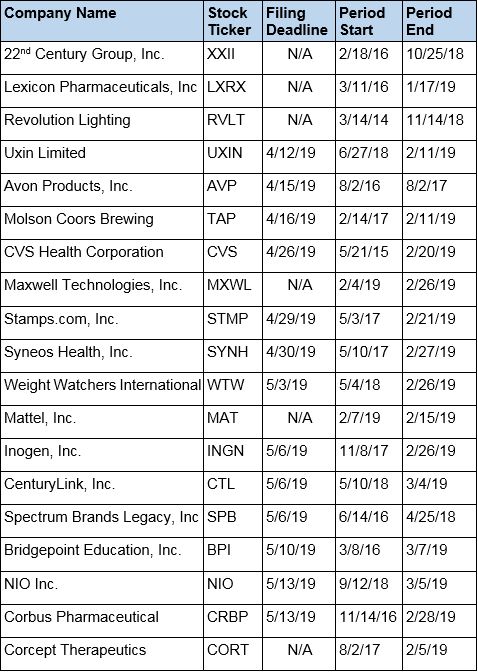

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.