Levi & Korsinsky Announces AGN Lawsuit; AGN Class Action

Levi & Korsinsky, LLP

January 17, 2019

Cook v. Allergan PLC et al 1:18-cv-12089 — On December 21, 2018, investors sued Allergan plc. (“Allergan” or the “Company”) in United States District Court, Southern District of New York. Plaintiffs in the AGN class action allege that they acquired Allergan stock between May 9, 2017 and December 19, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the AGN Lawsuit, please contact us today!

Summary of the Allegations

Company Background

According to its website, Allergan (NYSE: AGN) is a “bold, global pharmaceutical company.”

As such, the Company focuses on the development, manufacturing, development and marketing of “branded pharmaceutical, device, biologic, surgical and regenerative medicine products for patients around the world.” Specifically, the Company says it markets “portfolio of leading brands and best-in-class products” for use in the treatment of ailments affecting the central nervous system, eye care, cosmetic surgery and dermatology, gastroenterology, women’s health, urology and anti-infective therapeutic categories.

In all, Allergan says it has 17,000 employees and a presence in approximately 100 countries.

According to the December 21 complaint, more than 345 million shares trade on the New York Stock Exchange.

Summary of Facts

Allergan and three of its senior officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s products during the Class Period.

Specifically, they are accused of failing to disclose truthful information about the status of Allergan’s textured breast implants and tissue expanders during quarterly earnings calls. By knowingly or deliberately doing so, they allegedly caused Allergan stock to trade at artificially inflated prices during the time in question.

The truth came out on December 19, 2018, when the Company announced that it had halted the sale of its textured breast implants and tissue expanders and “was withdrawing all remaining supplies from European markets.”

According to the December 21 complaint, the withdrawal “followed a compulsory recall request from the Agence Nationale de Sécurité du Médicament (“ANSM”), the French regulatory authority.” The suspension of sales “stemmed directly from the expiration of the Company’s CE Mark for these products.”

A closer look…

As also alleged in the December 21 complaint, Allergan and/or the Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, during a conference call held at the beginning of the Class Period to discuss the Company’s quarterly earnings, one of the Individual Defendants bragged about “the Company’s progress in securing ‘major pharma and device approvals.’” The same person also bragged that Allergan had “additional indications for [its] breast implants and fillers.”

Then, during another earnings call held on February 6, 2018, a different Individual Defendant said in relevant part: “In Plastics and Regenerative Medicine, fourth quarter U.S. sales were exceptionally strong, up 15% on a pro forma basis versus last year. Growth in this segment has been driven primarily by ALLODERM, our tissue matrix for breast reconstruction, which is exceeding expectations; and market share gains for our 2 new INSPIRA breast implants.”

Finally, on another earnings call held on July 26, 2018, one of the Individual Defendants said in relevant part: “In Plastics and Regenerative Medicine, ALLODERM, our tissue matrix for breast reconstruction, continues to exceed expectations. ALLODERM sales were up 26%. This product is becoming part of the standard care in reconstructive surgeries.”

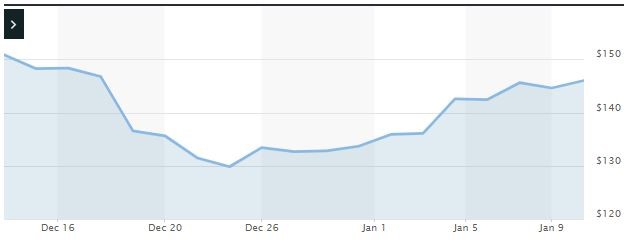

Impact of the Alleged Fraud on Allergan’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$146.76 |

| Closing stock price the trading day after disclosures:

|

$136.56 |

| One day stock price decrease (percentage) as a result of disclosures:

|

6.95% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is February 19, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Allergan common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.