CWH Class Action: Levi & Korsinsky Announces CWK Lawsuit

Levi & Korsinsky, LLP

October 31, 2018

Ronge v. Camping World Holdings, Inc., et al 1:18-cv-07030 — On October 19, 2018, investors sued Camping World Holdings, Inc., (“Camping World” or the “Company”) in United States District Court, Northern District of Illinois Eastern Division. Plaintiffs in the CWH class action allege that they acquired Camping World stock at artificially inflated prices between March 8, 2017 and August 7, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the CWH lawsuit, please contact us today!

Summary of the Allegations

Company Background

The Company (NYSE: CWH) bills itself as “the leading outdoor and camping retailer.” As such, Camping World sells “an extensive assortment” of recreational vehicles (“RV”s) along with related RV and camping gear.

In addition to providing RV maintenance and repair services, Camping World claims that it offers “the industry’s broadest and deepest range of services, protection plans, products and resources.”

Camping World has been in business for more than 50 years and maintains its headquarters in Lincolnshire, Illinois. According to its website, it has more than 135 retail locations in 36 states and a “comprehensive e-commerce platform.”

Summary of Facts

Camping World, three of its senior officers and/or directors (the “Individual Defendants”), and a private equity firm and an investment adviser (the “Crestview Defendants”) are now accused of deceiving investors by lying and withholding critical information about the Company’s business practices and financial condition during the Class Period.

Specifically, they are accused of omitting truthful information about certain financial results and certain issues stemming from its acquisition of Gander Stores, from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Camping World stock to trade at artificially inflated prices during the time in question.

The truth emerged in a series of events beginning during a three-day period between February 27 and March 1, 2018. That’s when the Company reveled “a host of accounting errors and the need to delay the filing of its 2017 annual financial report.”

Then, on a form filed with the SEC on March 13, 2018, the Company admitted that it identified some “material weaknesses” in its internal controls over financial reporting. Due to these deficiencies, the Company said its internal controls over financial reporting were not effective as of December 31, 2017. On the same form, the Company also acknowledged that its disclosure controls and procedures were not effective as of December 31, 2016, March 31, 2017, June 30, 2017, September 30, 2017 and December 31, 2017.

On May 8, 2018, Camping World also reported “disappointing financial results for the quarter ended March 31, 2018.”

Everything came to a head on August 7, 2018, when the Company again reported “disappointing financial results,” this time for the quarter ended June 30, 2018. To make matters worse, the Company also admitted that, “problems in its Gander operations were more extensive than previously disclosed.”

A closer look…

As alleged in the October 19 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in a May 1, 2017 press release announcing that it was the winning bidder at a bankruptcy auction for “certain assets of Gander and its Overton’s boating business,” the Company stated in relevant part: “While we are obligated to assume a minimum of seventeen leases, our designation rights will allow us to operate stores and retain employees at a number to maximize profitability.”

Then, in a follow-up press release issued on May 8, 2017, the Company said in pertinent part: “As part of the Agreement, Camping World obtained the right to designate any real estate leases for assignment to Camping World or other third parties and initially plans to operate stores that it believes to have a clear path to profitability.”

Finally, in a press release issued January 4, 2018, the Company again asserted that the (Gander) stores would be operated with “a clear path to profitability.”

Impact of the Alleged Fraud on Camping World’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$22.21 |

| Closing stock price the trading day after disclosures:

|

$19.04 |

| One day stock price decrease (percentage) as a result of disclosures:

|

14.27% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is December 18, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Camping World common stock using court approved loss calculation methods.

Recently Filed Cases

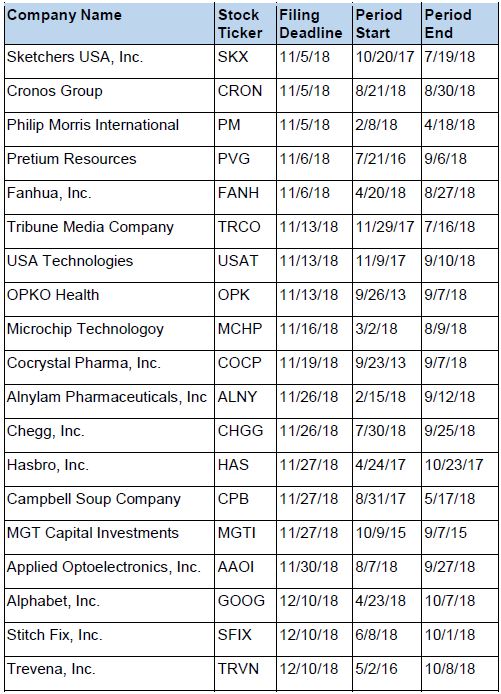

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us today.