HAS Lawsuit; Levi & Korsinsky Announce Hasbro Class Action

Levi & Korsinsky, LLP

October 10, 2018

City of Warren Police and Fire Retirement System v. Hasbro, Inc., et al 1:18-cv-00543-WES-LDA–On September 28, 2018, investors sued Hasbro, Inc. (“Hasbro” or “the Company”) in United States District Court, District of Rhode Island. The Hasbro class action alleges that plaintiffs acquired Hasbro stock at artificially inflated prices between April 24, 2017 and October 23, 2017 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the HAS Lawsuit please contact us today.

Summary of the Allegations

Company Background

Hasbro (NASDAQ:HAS) bills itself as “a global play and entertainment company.” As such, it says it is dedicated to “Creating the World’s Best Play Experiences” through its “toys and games to television, movies, digital gaming and consumer products.”

In all, Hasbro says, its “extraordinarily robust portfolio” includes more than 1,500 brands. The Company also says that it works with “many of the industry’s best partners, including STAR WARS, MARVEL, DISNEY PRINCESS and DISNEY FROZEN, as well as DREAMWORKS TROLLS and SESAME STREET.”

Hasbro is based in Pawtucket, Rhode Island.

Summary of Facts

Hasbro and two of its senior officers and/or directors (the “Individual Defendants”) now stand accused of deceiving investors by lying and withholding critical information about the Company’s business practices and prospects during the Class Period.

Specifically, they are accused of omitting truthful information about its sales in key foreign markets and the financial status of one of its largest customers (Toys “R” Us) from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Hasbro stock to trade at artificially inflated prices during the time in question.

The truth came out in a series of events on October 23, 2017. First, the Company issued a press release announcing third quarter 2017 financial results for the period that ended on October 1, 2017. In it, Hasbro admitted that the Toys “R” Us bankruptcy filing in the United States and Canada had a “negative impact on our quarterly revenues and operating profit.”

In an ensuing conference call with analysts and investors held to discuss the Company’s earnings and operations, both Individual Defendants commented on ongoing sales difficulties in the U.K. and Brazil. One said in pertinent part: “The challenges we saw emerging in the second quarter have continued in the U.K. and Brazil, and we anticipate this will continue for the remainder of the year.”

A closer look…

As alleged in the September 28 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements throughout the Class Period.

For example, during a conference call with analysts and investors held at the beginning of the Class Period, one of the Individual Defendants said in relevant part: “We are well positioned to execute against the storytelling and brand initiatives for the year while investing to expand the reach of our brands and deliver profitable growth for this year and future years.”

In response to a question about the Company’s “customer relationship” with Toys “R” Us during the conference call, the same Individual Defendant also said in pertinent part: “So I’d say, overall, we’re partnering with that retailer and all our retailers, both in-store and omnichannel online. And we are seeing a great convergence of content, commerce and innovation happening at retail and also particularly in the online space.”

Then on a July 24, 2017 conference call with analysts and investors, the same Individual Defendant stated in relevant part: “…the U.K. and Brazil are facing challenging macroeconomic issues impacting both consumers and retailers. This is having a near-term impact on our revenue and operating profit in the international segment, but our full year outlook for this segment is positive.”

Impact of the Alleged Fraud on Hasbro’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$92.69 |

| Closing stock price the trading day after disclosures:

|

$89.75 |

| One day stock price decrease (percentage) as a result of disclosures:

|

3.17% |

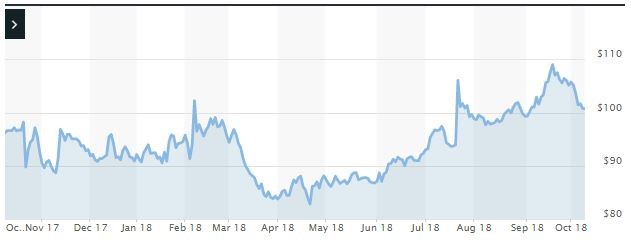

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is November 27, 2018. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Hasbro common stock using court approved loss calculation methods.

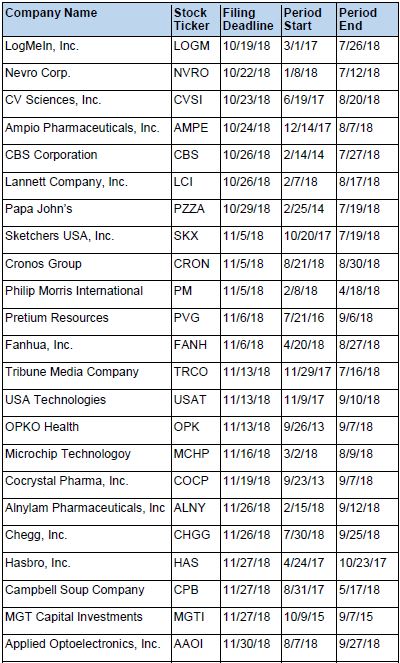

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.