Levi & Korsinsky Investigates LHSIF Lawsuit; LHSIF Class Action

Levi & Korsinsky, LLP

January 31, 2019

Lin v. Liberty Health Sciences, Inc., et al 1:19-cv-00161-LTS — On January 7, 2019, investors sued Liberty Health Sciences, Inc. (“Liberty” or the “Company”) in United States District Court, Southern District of New York. The federal securities class action alleges that plaintiffs acquired Liberty stock at artificially inflated prices between June 28, 2018 and December 3, 2018 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more on the LHSIF Lawsuit, contact us today!

Summary of the Allegations

Company Background

According to its website, the Company (OTC: LHSIF) was launched to acquire and operate U.S. – based companies in the medical cannabis market.”

As such, the Company says it, “adds value to acquired companies” through its expertise in the field and through its proprietary processes. Today, it is primarily engaged in the “production and distribution of medical cannabis through its wholly-owned subsidiary, DFMMJ LLC,” or Liberty Health Sciences, Ltd.

As set forth in the January 7 complaint, Liberty also has “longstanding ties” with Aphria, Inc., another cannabis distributor and producer. Specifically, the complaint notes that Aphria CEO and co-founder Victor Neufield also became the chairman of Liberty; and that Aphria co-founder and chief agronomist Cole Cacciavillanii also joined Liberty as an executive. As a result, the complaint alleges, “Liberty was heavily influenced by Aphria and individuals involved in the management of Aphria.”

Summary of Facts

Liberty and two of its senior officers (the “Individual Defendants”) are now accused of deceiving investors by lying and withholding critical information about Liberty’s business practices during the Class Period.

Specifically, they are accused of omitting truthful information about the purpose of certain transactions and acquisitions from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Liberty stock to trade at artificially inflated prices during the time in question.

The truth emerged in a series of events that began when Aphria announced that it had “sold off its stake in Liberty” in September 2018, and continued in December 2018. On December 3, 2018, Quintessential Capital Management and Hindenburg Research issued a report accusing Aphria of being a participant in a scheme “involving the acquisition of shell companies at artificially inflated prices.”

Then, on December 6, 2018, the mainstream media followed up on a second report issued by Hindenburg Research. Specifically, the Windsor Star published an article detailing Aphria’s ties to Liberty and related allegations.

A closer look…

As alleged in the January 7 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in an Annual Information Form (the “2018 AIF) released on June 28, 2018, the Company detailed an Investor Rights Agreement, stating in pertinent part: “Concurrently with the completion of the Business Combination, Liberty entered into an investor rights agreement (the “Investor Rights Agreement”) pursuant to which, among other things, Aphria is entitled to certain director nomination and pre-emptive rights.”

In the 2018 AIF, Liberty also detailed its relationship with the Serruya family, which “holds a large stake in both Liberty and Aphria.” Within this context, the Company stated in pertinent part: “On February 5, 2018, it was announced that a group of buyers led by members of the Serruya family had entered into a purchase and sale agreement with Aphria to purchase all of the Common Shares in the Company owned by Aphria that are not subject to CSE escrow requirements over the course of the next two and a half years.”

Finally, in a document called Management’s Discussion & Analysis (the “2018 MD&A”) also issued on the same day, the Company included examples of “Liberty and Aphria’s commingling interests in acquiring other businesses.” In this context Liberty stated in relevant part: “In February 2018, the Company entered into a definitive agreement with Aphria Inc. (“Aphria”) to acquire Aphria’s minority interests in Copperstate Farms, LLC and Copperstate Farms Investors, LLC (collectively, “Copperstate”), through a purchase of Aphria’s wholly-owned subsidiary, Aphria (Arizona) Inc., for a purchase price of $20.0 million.”

Impact of the Alleged Fraud on Liberty’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$1.06 |

| Closing stock price the trading day after disclosures:

|

$0.70 |

| One day stock price decrease (percentage) as a result of disclosures:

|

33.96% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is March 8, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Liberty common stock using court approved loss calculation methods.

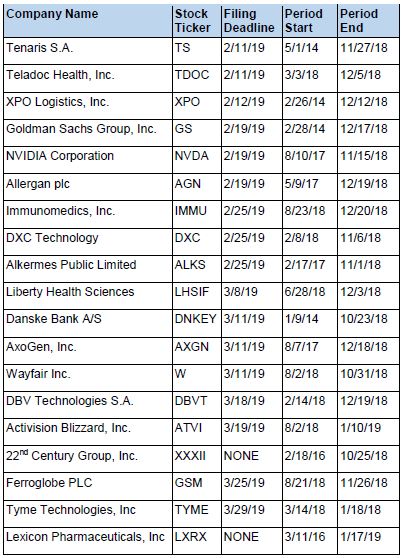

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.