Levi & Korsinsky Announce TLGT Lawsuit; TLGT Class Action

Levi & Korsinsky, LLP

May 9, 2019

Mo-Kan Iron Workers Pension Fund v. Teligent, Inc. et al 1:19-cv-03354-VM — On April 15, 2019, investors sued Teligent, Inc. (“Teligent” or the “Company”) in United States District Court, Southern District of New York. The TLGT class action alleges that the plaintiffs acquired Teligent stock at artificially inflated prices between May 2, 2017 and November 7, 2017 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the TLGT Lawsuit, please contact us today!

Summary of the Allegations

Company Background

Teligent (NASDAQ: TLGT) is a self-described specialty generic pharmaceutical company.

As such, its mission is to “be a leading player in the specialty generic prescription drug market.” To accomplish this, Teligent researches and engages in the development, production, distribution and sales of generic drugs.

According to the investor portion of its website, the Company had 22 Abbreviated New Drug Applications (ANDAs) on file at the FDA, representing a total addressable market of approximately $1.6 billion as of last June.

Teligent is incorporated in Delaware and its headquarters are located in Buena, New Jersey.

Summary of Facts

Teligent and its President/CEO (collectively the “Defendants”) are now accused of deceiving investors by lying and/or withholding critical information about the Company’s business practices, and operational and compliance policies during the Class Period.

Specifically, they are accused of omitting truthful information about certain product “non-conformities” and compliance (or lack thereof) with applicable regulations from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Teligent stock to trade at artificially inflated prices during the time in question.

The initially surfaced after the market closed on November 6, 2017. That’s when the Company issued a press release announcing its results for the third quarter of 2017. According to the April 15 complaint, the press release “exposed the depths of Teligent’s R&D, production and legal issues.”

A closer look…

As also alleged in the April 15 complaint, the Defendants repeatedly made false and misleading public statements during the Class Period.

First, the Company “highlighted its revenue growth in the first quarter of 2017” on a form filed with the SEC on May 2, 2017.

Then in an ensuing earnings call, Teligent’s President/CEO stated in relevant part: “This growth has been driven by a combination of new product launches and competitive supply chain dynamics to which Teligent has been able to respond effectively.”

On the same conference call, Teligent’s President and CEO also stated in relevant part: “To the extent that we can replicate these timely approvals with our current investments in R&D, we will continue to deliver value in the form of the return on these investments as we launch products to the market.”

What the Company and its President/CEO allegedly failed to disclose, however, was that Teligent was experiencing “product non-conformities in R&D, and non-compliance with applicable regulations.”

Impact of the Alleged Fraud on Teligent’s Stock Price and Market Capitalization

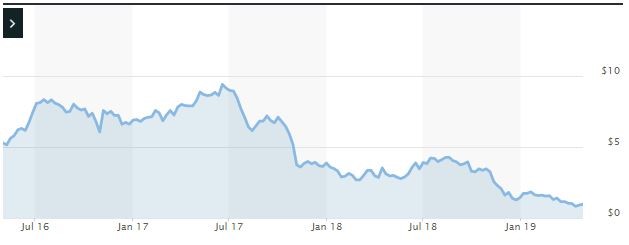

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is June 14, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Teligent common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.