Levi & Korsinsky Announce VNDA Lawsuit; VNDA Class Action

Levi & Korsinsky, LLP

March 18, 2019

Gordon v. Vanda Pharmaceuticals, Inc., et al 1:19-cv-01108-APR-LB — On February 25, 2019, investors sued Vanda Pharmaceuticals, Inc. (“Vanda” or the “Company”) in United States District Court, Eastern District of New York. The VNDA class action alleges that plaintiffs acquired Vanda stock at artificially inflated prices between November 4, 2015 and February 11, 2019 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information on the VNDA lawsuit, please contact us today!

Summary of the Allegations

Company Background

The Company (NASDAQ: VNDA) is a self-described global biopharmaceutical company. As such, it specializes in the development and mass marketing of new and unique treatments to address significant unmet medical needs.

Vanda’s products include HETLIOZ (tasimelteon), which is for the treatment of non-24-hour sleep-wake disorders; and Fanapt (iloperidone), which is used to treat schizophrenia.

The company has been incorporated since 2002 and is headquartered in Washington, D.C. In addition to the United States, Vanda promotes its products in Europe and Israel.

Summary of Facts

Vanda and two of its senior officers (the “Individual Defendants”) are now accused of deceiving investors by lying and withholding critical information about the Company’s business practices and operations during the Class Period.

Specifically, they are accused of omitting truthful information about Vanda’s conduct from SEC filings and related material during the Class Period. By knowingly or recklessly doing so, they allegedly caused Vanda stock to trade at artificially inflated prices during the time in question.

The truth came out in a series of events occurring on October 22, 2018 and February 11, 2019. First, the FDA sent Vanda a warning letter based on its review of the Company’s website, which it found, “false and misleading.” The website raised concerns because it allegedly failed to “disclose risks of Fanapt and Hetlioz in violation of the Federal Food, Drug and Cosmetic Act.”

Then, on February 11, Aurelius Value published a report revealing “a previous unreported qui tam lawsuit which disclosed Vanda’s years of fraudulent promotion of Fanapt and Hetlioz.” The same report about the Company and lawsuit also disclosed Vanda’s alleged scheme to “defraud the government with fraudulent reimbursements.”

A closer look…

As alleged in the February 25 complaint, the Company and/or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For instance, in a conference call held at the outset of the Class Period to discuss its third quarter 2015 earnings, Vanda said in pertinent part: “We are seeking to stabilize the Fanapt revenue with active commercial efforts.”

In another example, a form filed with the SEC on February 17, 2017 included certifications signed by the Individual Defendants in accordance with federal law. In the certifications, they attested to “the accuracy of financial reporting, the disclosure of any material changes to the Company’s internal control over financial reporting and the disclosure of all fraud.”

Finally, on a form filed with the SEC on February 15, 2018, the Company discussed the “uses and marketing of Fanapt and Hetlioz,” stating in relevant part: “In January 2014, HETLIOZ was approved in the U.S. for the treatment of Non-24. Non-24 is a serious, rare and chronic circadian rhythm disorder characterized by the inability to entrain (synchronize) the master body clock with the 24-hour day-night cycle. HETLIOZ is the first FDA approved treatment for Non-24.”

On the same form, the Company also stated in pertinent part: “Fanapt is a product for the treatment of schizophrenia. In May 2009, the FDA granted U.S. marketing approval of Fanapt for the acute treatment of schizophrenia in adults.”

Impact of the Alleged Fraud on Vanda’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$18.95 |

| Closing stock price the trading day after disclosures:

|

$18.00 |

| One day stock price decrease (percentage) as a result of disclosures:

|

5.01% |

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is April 26, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Vanda common stock using court approved loss calculation methods.

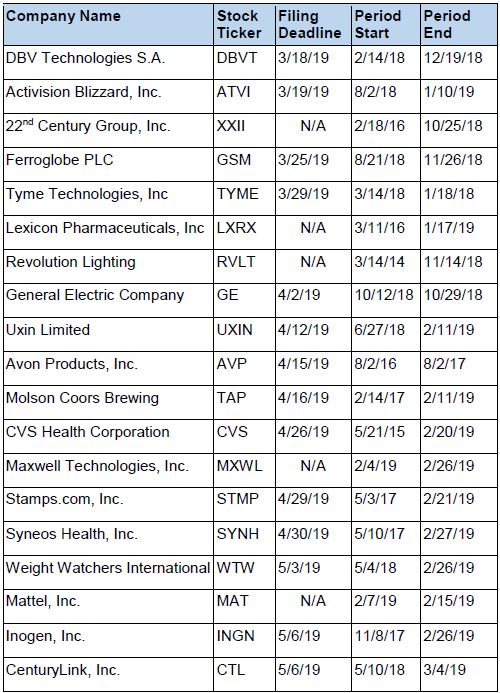

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.