Levi & Korsinsky Announce WTW Lawsuit; WTW Class Action

Levi & Korsinsky, LLP

April 2, 2019

Potts v. Weight Watchers International Inc., et al 1:19-cv-02005-WHP — On March 4, 2019, investors sued Weight Watchers International (“Weight Watchers” or the “Company”) in United States District Court, Southern District of New York. Plaintiffs in the WTW class action allege that they acquired Weight Watchers stock at artificially inflated prices between May 4, 2018 and February 26, 2019 (the “Class Period”). They are now seeking compensation for financial losses incurred upon public revelation of the Company’s alleged misconduct during that time. For more information about the WTW Lawsuit, contact us today!

Summary of the Allegations

Company Background

The Company (NASDAQ: WTW) is a global provider of weight management services. As such, it has divisions catering to clients in North America, Continental Europe, the United Kingdom, and other parts of the world.

Traditionally, the Company’s offerings included various products and services designed to help people lose weight and keep it off. Its driving force is the use of a “science-driven approach to help participants lose weight by forming healthy eating habits, eating smarter, getting more exercise and providing support.”

Weight Watchers generates revenue through various subscriptions, fees for workshops and related activities, sales of consumer products, and other sources.

According to the March 4 complaint, the Company “recently rebranded its self as ‘WW’ and tried to focus less on weight loss and more on maintaining general health.”

Summary of Facts

Weight Watchers and two of its senior officers (the “Individual Defendants”) and Artal Group S.A. (which effectively controlled Weight Watchers during the Class Period) now stand accused of deceiving investors. They allegedly did so by lying and/or withholding critical information about the Company’s business practices and prospects during the time in question.

Specifically, they are accused of omitting truthful information about subscriber growth from SEC filings and related material. By knowingly or recklessly doing so, they allegedly caused Weight Watchers stock to trade at artificially inflated prices during the Class Period.

The truth came out after trading ended on February 26, 2019. That’s when the Company issued a press release and held a conference call with investors and stock analysts to discuss its “actual 4Q2018 and FY18 results and financial prospects.” In doing so, the Company revealed that the subscriber count had again dipped to 3.9 million during the fourth quarter, and acknowledged that the decline would continue during the 2019 fiscal year.

A closer look…

As alleged in the March 4 complaint, the Company and /or Individual Defendants repeatedly made false and misleading public statements during the Class Period.

For example, in remarks made at the beginning of the Class Period, one of the Individual Defendants said in pertinent part: “Member engagement has been incredible with members staying longer than ever before. Average retention is now well over nine months.”

During a conference call with investors and stock analysts on May 3, 2018, the same Individual Defendant stated in relevant part: “We ended the quarter with 4.6 million subscribers worldwide, the highest level in the history of Weight Watchers, driven by the enthusiastic global response to our new program.”

Finally, the Company filed a Registration Statement related to a secondary public offering being carried out for Artal Group S.A. with the SEC on May 14, 2018. In it, the Company stated in relevant part: “Our strong brand, together with the effectiveness of our program, loyal customer base, unparalleled network of meetings and leaders and strong digital offerings, enable us to attract and retain both new and returning customers.”

Impact of the Alleged Fraud on Weight Watcher’s Stock Price and Market Capitalization

| Closing stock price prior to disclosures:

|

$29.57 |

| Closing stock price the trading day after disclosures:

|

$19.37 |

| One day stock price decrease (percentage) as a result of disclosures:

|

34.50% |

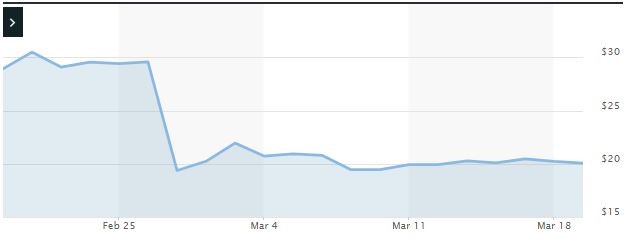

The following chart illustrates the stock price during the class period:

Actions You May Take

If you have purchased shares during the Class Period, you may join the class action as a lead plaintiff, remain a passive class member, or opt out of this litigation and pursue individual claims that may not be available to the class as a whole.

NOTE: The deadline to file for lead plaintiff in this class action is May 3, 2019. You must file an application to be appointed lead plaintiff prior to this deadline in order to be considered by the Court. Typically, the plaintiff or plaintiffs with the largest losses are appointed lead plaintiff.

In order to identify your potential exposure to the alleged fraud during the time in question, you may wish to perform an analysis of your transactions in Weight Watchers common stock using court approved loss calculation methods.

Recently Filed Cases

Listed below are recently filed securities class action cases being monitored by us, along with the class period and the deadline to file a motion to be appointed as the Lead Plaintiff in the action. Please contact us if you would like an LK report for any of these cases:

About Us

Levi & Korsinsky is a leading securities litigation firm with a hard-earned reputation for protecting investors’ rights and recovering losses arising from fraud, mismanagement and corporate abuse. With thirty attorneys and offices in New York, Connecticut, California and Washington D.C., the firm is able to litigate cases in various jurisdictions in the U.S., England, and in other international jurisdictions.

Levi & Korsinsky provides portfolio monitoring services for high-net worth investors and institutional clients. Our firm also assists investors in evaluating whether to opt-out of large securities class actions to pursue individual claims.

For additional information about this case or our institutional services, please contact us.